Get Paid with BlinkPay – Accept Payments Online in New Zealand

New Zealand's first payment gateway purpose-built on the open banking standard. Accept direct bank payments from consumers with faster settlement, lower fees and secure API integration — no cards, no chargebacks, just smarter payments.

What's Holding Your Payments Back?

Explore common payment challenges and discover how BlinkPay provides elegant, effective solutions to help your business thrive.

Why does it take so long to get paid?

Settlement delays are a thing of the past. While traditional methods take days, with BlinkPay most transactions are settled in your bank account within hours, improving your cash flow and business agility.

- Hours to settlement, instant confirmation

Why are payment fees eating into my profits?

Traditional payment processors charge 2.9% + fees, but BlinkPay caps fees at just $3 maximum. Save significantly on every transaction while maintaining the same level of service and security.

- Ditch high fees

Why do payments keep failing?

Card payments fail due to expired cards, insufficient funds, or technical issues. BlinkPay's bank-to-bank payments have higher success rates and clearer failure messaging.

- Real payments from real bank accounts

Why Choose BlinkPay For Accepting Payments Online?

Lower fees, faster settlement, enterprise-grade security and dedicated support — BlinkPay is the modern way for businesses to accept online payments.

Faster Settlements

Most payments settle within 2 hours and merchants are notified straight away.

Lower Fees

Up to 70% savings compared to credit card fees.

Secure by Design

ISO/IEC 27001:2022 certified and no screen scraping.

Dedicated Support from Payment Experts

Our team offers support from specialists who really understand payments.

Faster Settlements

Most payments settle within 2 hours and merchants are notified straight away.

Lower Fees

Up to 70% savings compared to credit card fees.

Secure by Design

ISO/IEC 27001:2022 certified and no screen scraping.

Dedicated Support from Payment Experts

Our team offers support from specialists who really understand payments.

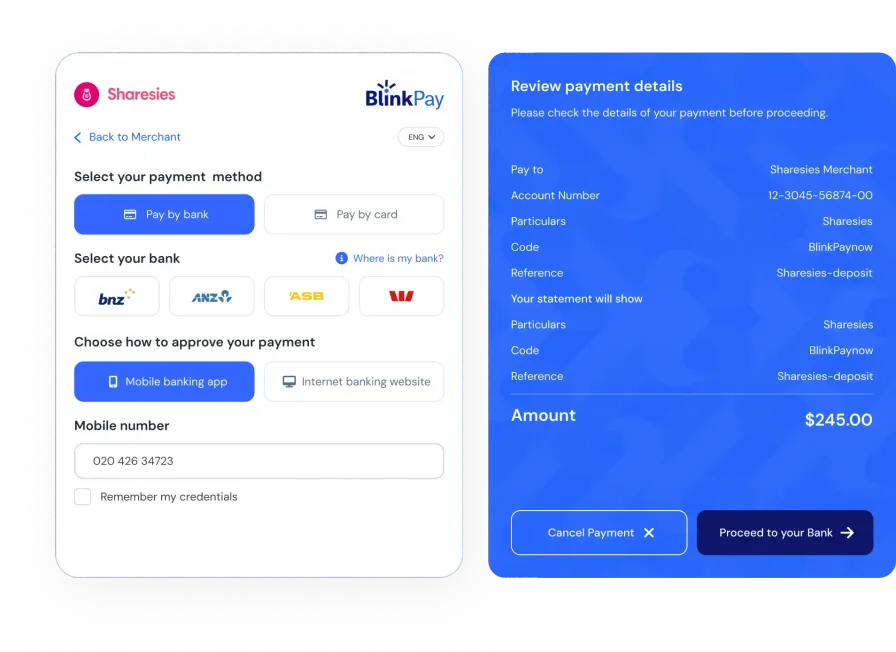

Seamless Payments, Delivered Instantly

A simple, secure and fast way to accept payments.

Customer Selects BlinkPay

Customer chooses BlinkPay as their payment method at checkout for a seamless experience

Secure Bank Login

They securely log in to their bank

Secured with encryption

Faster Settlements

Payment is authorised and settled directly to your account -- typically within 2 hours

Blink AutoPay - Smart Recurring Payments

Modern replacement for Direct Debit with instant approval and complete customer control

Future Cashflow Secured

Lock in predictable revenue once customers approve.

Setup in Minutes

Easy onboarding, no complex paperwork.

Error-Free Processing

Funds settle into the right account every time.

Revenue Recovery

Built-in alternatives if payments fail.

AutoPay vs Direct Debit

BlinkPay vs Competition

Compare BlinkPay with other payment solutions

Stripe

Account2Account

Ready to switch?

Looking for a Stripe alternative in NZ? See why businesses are switching to BlinkPay for faster, cheaper and more secure payments.

Ready to switch?

Looking for a Stripe alternative in NZ? See why businesses are switching to BlinkPay for faster, cheaper and more secure payments.

Blink Request to Pay – Real-Time Revenue Collection

Send a secure payment request straight into their mobile banking app, which can be approved on the spot!

Overdue Bill Collection

Get paid faster, without the chase.

Turn overdue balances into real-time revenue collection with a single request.

Charity Donations

Make giving instant and effortless.

Let donors support your kaupapa in just a few taps.

Subscription Renewals

Keep customers connected — and reduce churn.

Renew annual subscriptions seamlessly with quick, in-app approvals.

Invoice Payments

Faster settlement, happier cashflow.

Send a request, get paid within minutes — simple.

BlinkPay Instant is Coming Soon.

The fastest way to get paid is almost here. Join the priority waitlist.

Faster Cashflow

Cashflow that keeps up with you.

Improve working capital by removing settlement delays — your money arrives immediately after the customer approves.

Instant Payment for Big Purchases

Get paid on the spot.

When customers buy high-value items, you receive cleared funds immediately — no waiting, no risk.

Instant Top-Ups

Top up, ready to go.

Customers can load wallets or accounts instantly, with funds available the moment they pay.

Immediate Access to Funds

Money you can use right away.

Payments land instantly in your account, helping you move faster and keep your business running smoothly.

Seamless Integration

Integration

Transform your Xero invoicing with our native integration - no technical knowledge required

Simple Setup

Install BlinkPay App

Install BlinkPay from Xero App Store (NZ)

Send Invoices as Usual

Send invoices as usual

Payment Button Appears

Customers see "Pay with BlinkPay" button

Auto-Populate References

Payment references auto-populate

Automatic Reconciliation

Automatic reconciliation on payment

Key Benefits

Zero Technical Setup

No complex configuration or technical knowledge required

Perfect Reconciliation

Every payment automatically matches to the correct invoice

Faster Payment Collection

Customers can pay instantly, improving your cash flow

Existing Workflow

Works seamlessly with your current Xero invoicing process

Ready to Get Started?

Trusted by Leading Kiwi Businesses

Join the growing number of businesses using BlinkPay

"Whale Watch Kaikoura Ltd has now been using Blinkpay as a payment option for our customers for over 2 years and find this to be the best payment option we have."

Angela C.

Finance & Administration Manager

Whale Watch,

Kaikoura NZ

"BlinkPay's security ethos was a major factor in our partnership. We prioritize protecting our investors' data and BlinkPay's approach of not handling or retaining payments data gives our investors peace of mind when making instant transfers."

Brooke R.

Co-CEO

Sharesies,

Wellington

"BlinkPay is redefining the way payments are made in Aotearoa New Zealand, delivering a seamless and efficient solution that benefits both businesses and consumers."

Jonathon D.

Head of Payment Development

BNZ,

Auckland

Frequently Asked Questions

Find answers to common questions about how BlinkPay works and how to accept payments securely and easily.